Premier Energies has become a significant player in the renewable energy sector, driving interest among investors and industry analysts. With a growing demand for clean energy solutions, Premier Energies share price reflects its strong market presence and ambitious expansion plans. This article delves into Premier Energies share price trends, financial performance, and what the future holds for this renewable energy leader.

Overview of Premier Energies and Its Market Presence

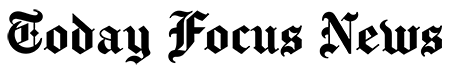

Premier Energies is one of India’s leading integrated solar cell and solar module manufacturers. Established in 1995, the company has grown exponentially over the years, offering a range of renewable energy solutions. Its product portfolio includes solar cells, monofacial and bifacial modules, and turnkey solar power plant solutions. The company’s vertically integrated operations allow for greater efficiency and cost-effectiveness, positioning it as a key player in the renewable energy market. Premier Energies share price reflects the company’s growing influence and market leadership.

As of 2024, Premier Energies boasts an annual installed capacity of 2 GW for solar cells and 3.36 GW for solar modules. This significant capacity places the company among the top renewable energy producers in the country, attracting substantial investor interest and government support, which positively impacts Premier Energies share price.

Premier Energies Share Price – Current Trends and Historical Performance

Premier Energies share price has experienced significant growth, reflecting the company’s expanding footprint and solid financial performance. As of December 2024, Premier Energies share price stood at INR 1,353, a notable increase from the previous year. This upward trend highlights investor confidence in the company’s growth trajectory and renewable energy projects.

Over the past five years, Premier Energies share price has consistently outperformed market expectations, driven by strategic expansions and rising demand for solar power solutions. The company’s focus on innovation and high-quality manufacturing has solidified its position as a market leader.

Key Factors Influencing Premier Energies Share Price

Market Growth in the Renewable Energy Sector

The renewable energy sector is experiencing rapid growth, driven by global initiatives to reduce carbon emissions and shift towards sustainable energy. India, in particular, has set ambitious targets for renewable energy capacity, boosting demand for solar solutions. Premier Energies, as a leading manufacturer, is well-positioned to benefit from this trend, which has positively impacted Premier Energies share price.

Financial Performance and Profit Margins

Premier Energies has demonstrated impressive financial growth over recent years. In FY24, the company reported sales of INR 3,144 crore, a substantial increase from INR 1,429 crore the previous year. This surge in revenue reflects the company’s expanding market share and successful project executions, which has directly influenced Premier Energies share price.

Additionally, Premier Energies achieved a net profit of INR 231 crore in FY24, marking a significant turnaround from a net loss of INR 13 crore in the prior year. This improvement in profitability has enhanced investor confidence and contributed to the rising Premier Energies share price.

Expansion Plans and New Projects

Premier Energies has consistently invested in expanding its production capacity and entering new markets. In 2024, the company announced plans to establish a 1 GW solar module manufacturing facility, further strengthening its market presence. These expansion initiatives not only increase production capabilities but also enhance the company’s ability to meet growing demand, driving Premier Energies share price growth.

Investor Confidence and Shareholding Patterns

Investor confidence in Premier Energies is reflected in its shareholding pattern. As of September 2024:

- Promoters hold 64.25% of the shares

- Foreign Institutional Investors (FIIs) own 3.08%

- Domestic Institutional Investors (DIIs) account for 6.71%

- Public and retail investors hold 25.07%

This strong promoter holding suggests long-term confidence in the company’s vision and stability, further reinforcing its attractiveness to investors and positively influencing Premier Energies share price.

Competitor Analysis – How Premier Energies Stands Out

In the highly competitive renewable energy market, Premier Energies distinguishes itself through its integrated manufacturing processes, advanced technology, and focus on quality. Compared to other players, the company’s ability to produce both solar cells and modules gives it a competitive edge, ensuring greater control over the supply chain and reducing costs, which in turn supports Premier Energies share price.

Future Outlook for Premier Energies Share Price

Projected Growth in Renewable Energy Demand

The demand for renewable energy is expected to grow exponentially in the coming years. Premier Energies’ strategic position in the solar energy market aligns well with this anticipated growth, suggesting continued appreciation in Premier Energies share price.

Government Policies and Renewable Energy Incentives

Government initiatives and policies promoting renewable energy play a crucial role in shaping the industry’s future. Subsidies, tax benefits, and investment incentives for solar energy projects are likely to benefit Premier Energies, supporting Premier Energies share price growth.

Risks and Challenges Investors Should Consider

Despite its strong performance, investors should consider potential risks, including policy changes, market volatility, and operational challenges. Expanding manufacturing facilities and entering new markets involve inherent risks that could affect profitability and, subsequently, Premier Energies share price.

Is Premier Energies a Good Investment for the Long Term?

Premier Energies’ consistent growth, strong financial performance, and strategic expansions position it as an attractive long-term investment. However, investors should conduct thorough research and consider market dynamics before making investment decisions about Premier Energies share price.

Conclusion – Premier Energies’ Position in the Renewable Energy Market

Premier Energies has emerged as a key player in the renewable energy sector, with a robust market presence and promising growth prospects. Premier Energies share price reflects the company’s success and potential, making it a noteworthy consideration for investors. As the demand for renewable energy continues to rise, Premier Energies is poised to capitalize on future opportunities, driving sustained growth and shareholder value.